|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Car Breakdown Insurance Cover: A Comprehensive Coverage GuideWhen it comes to protecting your vehicle in the United States, car breakdown insurance cover can be a game-changer. Offering peace of mind and potential cost savings, this coverage is essential for those looking to avoid unexpected repair bills and gain financial security on the road. Understanding Car Breakdown InsuranceWhat is it? Car breakdown insurance, sometimes called roadside assistance or vehicle protection, covers repair costs if your car breaks down unexpectedly. This type of insurance ensures that you're not caught off guard by expensive repair bills. Why Consider Car Breakdown Insurance?Imagine driving through the bustling streets of New York or the expansive highways of California and experiencing a sudden vehicle failure. With car breakdown insurance, you can address these issues promptly without breaking the bank.

What's Covered?Car breakdown insurance typically covers a range of services that help you get back on the road quickly.

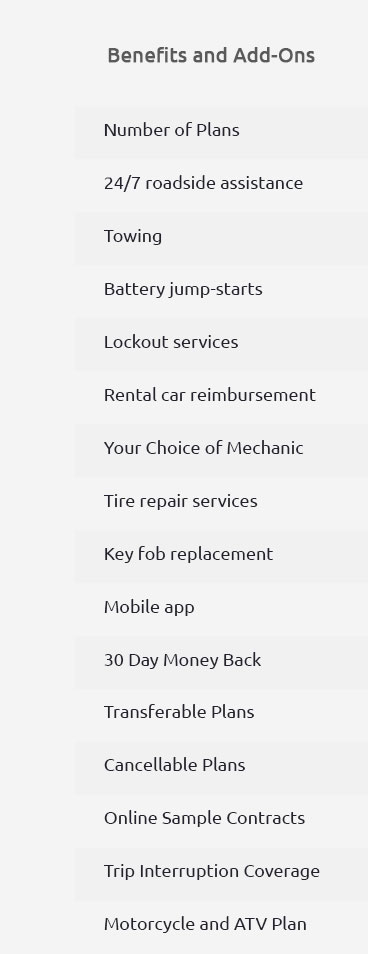

Extended Auto WarrantiesIn addition to breakdown insurance, consider prius warranty extension options for hybrid owners looking for extended coverage beyond standard warranties. Cost of Car Breakdown InsuranceThe cost of this insurance can vary based on the provider and the level of coverage. However, investing in this type of protection is often more economical than paying out-of-pocket for major repairs. For those driving in areas with high traffic like Los Angeles or harsh weather conditions in Chicago, the benefits far outweigh the costs. Additional ConsiderationsWhen selecting a policy, it's crucial to compare different providers and understand what's included. Some policies may offer optional coverage like trip interruption benefits or repair warranty insurance for additional peace of mind. FAQs About Car Breakdown Insurance CoverWhether you're cruising down Route 66 or navigating the urban jungle of New York City, car breakdown insurance cover offers invaluable protection and peace of mind. Stay informed, choose wisely, and ensure you're always ready for the road ahead. https://www.endurancewarranty.com/learning-center/mechanical-breakdown-insurance/why-mbi-is-essential-for-long-road-trips/

Mechanical breakdown insurance is an auto protection plan that covers the cost of repairs when the original factory warranty no longer safeguards your car. https://www.consumeraffairs.com/insurance/mechanical-breakdown-insurance.html

Mechanical breakdown insurance (MBI) is an insurance policy that covers your car's major parts and systems. It can help pay for repairs to your ... https://www.geico.com/claims/claimsprocess/understanding-mechanical-breakdown-claims/

If your vehicle is protected by GEICO's Mechanical Breakdown Insurance (MBI), you're covered for repairs (excluding ...

|